Payment Analytics: The Missing Link in Your Approval Rate Strategy

Payment success drives your revenue. Small lifts in approvals compound into millions in recovered sales. False declines and avoidable friction, on the other hand, erode margin and customer trust every day.

The numbers tell the story. Merchants lose an estimated $443 billion annually to false declines. These legitimate transactions get rejected by overly aggressive fraud filters. Meanwhile, the average online cart abandonment rate hovers around 70%. Payment friction accounts for a significant portion of those lost sales.

Most teams treat approval rate as a single KPI. But that hides the full story behind declines. It leaves revenue on the table.

Payment analytics fills the gap. It explains the "why" behind each decision. It shows where to act for quick gains.

Basic payment analysis only surfaces high-level trends. But comprehensive payment analytics connects the dots. It links transaction data to issuer behavior. And it also reveals customer patterns and operational outcomes.

You can integrate payment analytics into your routing, fraud detection, and checkout flows. When you do, you unlock actionable patterns. You'll see which:

- Issuers need network tokens

- Markets demand local acquiring

- Retries convert

- 3DS prompts cost you sales

This is how payment leaders lift authorization rates. They do it without adding friction or compromising the customer experience.

Understanding Payment Analytics

Payment analytics is the practice of collecting, unifying, and analyzing transaction data. It reveals what drives approvals, declines, chargebacks, and costs.

The scope is broad – it includes volumes, authorization outcomes, and reason codes. It covers fraud scores, payment methods, and issuer behavior. It tracks customer behavior cohorts. Done right, it becomes the control center for your payment processing engine, not just a dashboard.

This data connects payment outcomes to customer behavior and operational choices. It informs how you price, route, authenticate, and recover revenue.

Modern payment analytics platforms go beyond basic payment analysis. They deliver valuable insights and show why customers prefer certain methods. They also reveal how accepting payments across different channels impacts your long-term success.

Key metrics that move approval rates

Track payment metrics that explain outcomes and guide action.

- Start with authorization rate, decline reasons, and latency

- Add issuer, BIN, market, and method breakdowns. These show you where to intervene.

- Use fraud detection and 3DS metrics to separate risk control from conversion loss.

Effective analysis of payments requires considering both real-time signals and historical trends. The most successful teams use data-driven approaches – they continuously refine their acceptance strategies. They also treat payment data as a strategic asset, not operational noise.

How payment data differs from sales data

Sales data shows intent and product demand. Payment data shows whether money moved and why it didn't. It explains where cost and friction occur. At authorization, authentication, settlement, or recovery.

Payment analytics reveals weak spots and savings opportunities. General sales analytics can't see these.

For online payments, this distinction becomes critical. Sales analytics might show cart abandonment. But only payment analytics can tell you why customers left.

- Was it payment gateway errors?

- Limited payment methods?

- Authentication friction?

This granular view enables targeted fixes. You don't need broad checkout redesigns.

Limitations of Traditional Approval Rate Strategies

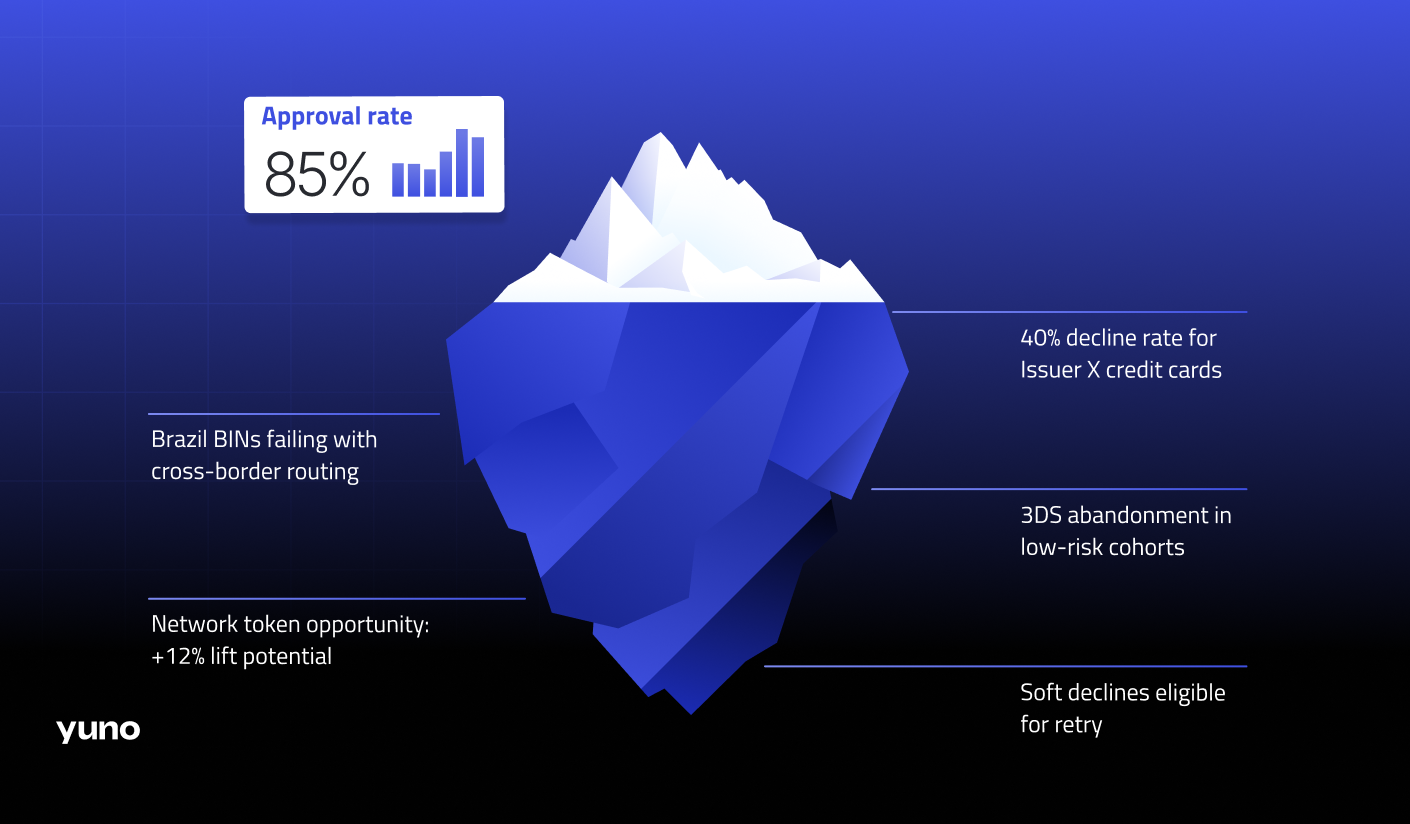

Ratios without context hide problems

A single approval rate conceals the drivers behind it. It masks issuer-specific behavior. It also hides BIN‑level rules and method or market differences.

Without context, you optimize averages. This makes you miss the levers that actually move revenue.

Traditional payment analysis may indicate that your overall approval rate is 85%. But it could miss important details – certain credit cards from specific issuers might be declining at 40%. Meanwhile, others approve at 95%. This lack of granularity costs you revenue every day.

Payment method preferences vary dramatically by region. Digital wallets account for 49% of global ecommerce transactions. Yet many merchants still route all payments through a single processor, without considering local preferences.

Missed optimization opportunities

Fragmented data across processors and gateways blocks clear analysis.

Teams miss:

- Underperforming providers

- Poor descriptor setups

- Tokenization gaps

Without a unified view, you can't prioritize fixes or quantify impact.

When transaction data lives in silos, you lose the ability to spot patterns. Patterns across payment methods and providers. You might miss that customers in Brazil prefer local payment options over credit cards. Or that suspicious activity correlates with specific device types.

These insights could dramatically improve both conversion and fraud prevention. The benefits compound over the long term.

No root-cause clarity

Traditional reports rarely normalize decline reason codes. They don't map them to actionable categories.

You see "Do not honor" and "Issuer unavailable." But you don't know what to do:

- Should you retry?

- Route differently?

- Change authentication?

That stops targeted improvements before they start.

The Power of Payment Analytics in Enhancing Approval Rates

Identify patterns and trends in failures

Analytics surfaces patterns by market, method, BIN, and time of day. You'll learn which:

- Issuers prefer network tokens

- Markets convert with local acquiring

- Latency spikes cut approvals

This context points directly to fixes – the ones that recover revenue fast.

Analyze these key patterns when reviewing payments:

- Declines by reason code category: issuer soft declines vs. hard declines vs. fraud

- BIN and issuer profiles: success with tokens, 3DS, or domestic routing

- Latency bands: where retries and cascades still succeed

- Time-based patterns: peak hours, weekend vs. weekday, seasonal trends

Personalize fraud detection and risk decisions

Real-time risk scoring enables tiered authentication. You can tier by customer, device, and BIN.

Good customers get a fast pass. Risky attempts get step-up checks or are blocked upstream.

This reduces false declines while keeping fraud in check. Move from blunt rules to adaptive risk and align fraud detection controls with approval goals.

Modern fraud detection goes beyond flagging suspicious activity. The best systems use customer behavior patterns. They distinguish between legitimate international purchases and actual fraud. This reduces false positives that damage the customer experience while maintaining security.

47% of consumers will avoid a merchant after experiencing a false decline. The cost isn't just the lost transaction. It's the lifetime value of that customer relationship.

Implementation strategies include:

- Pre-authorization screening filters obvious fraud before it hits your processor

- Dynamic 3DS triggers only when risk warrants it

- Cross-border signals strengthen issuer trust for legitimate buyers

- Device fingerprinting and behavioral analytics identify genuine long-term customers

Streamline checkout to cut friction

Analytics flags payment method failures, wallet issues, and authentication loops, all of which drive abandonment.

Measure drop-off by:

- Step

- Load time

- Method availability

Target fixes that increase conversion and downstream approvals.

The cleanest checkout wins. Your authorization rate reflects it.

When accepting payments across multiple channels, checkout optimization becomes complex. Payment analytics reveals exactly where friction occurs:

- Is it 3DS abandonment?

- Payment method availability?

- Load times?

- Form errors?

Customers prefer frictionless experiences. Data-driven optimization ensures you remove barriers without compromising security.

Implementing Payment Analytics in Your Strategy

Choose the right tools and platform

You need a platform that unifies data across providers. It should:

- Standardize reason codes

- Supply both real-time and batch analytics

- Expose APIs for experimentation

- Feed insights into payment routing, retries, and fraud detection controls

Make sure it scales globally. Make sure it supports local payment methods with issuer-grade context.

What Yuno enables

- One API to route across 200+ providers – full control without new integrations

- Unified analytics with normalized reason codes and BIN/issuer insights

- Smart payment routing that adapts to real-time performance signals

- Adaptive risk scoring aligned to conversion goals

- Enterprise-grade trust: PCI‑DSS Level 1 and 99.99% uptime

Merchants using Yuno often achieve approval rate lifts of around 8%. This happens after enabling smart routing and analytics‑driven experiments. Results depend on market mix, issuer profiles, and baseline setup.

Integrate analytics into your workflows

Bring all flows together:

- Web checkout

- In‑app

- Subscriptions

- In‑store

Stream payment events into a unified schema. Include provider, method, issuer, BIN, device, and risk fields.

Normalize decline reasons into action groups: retry, re‑route, authenticate, block. Then wire the insights back into your payment processing engine.

Integration approaches for comprehensive payment analysis:

- Event pipeline for real-time alerts and payment routing decisions

- Data warehouse for batch analysis, cohort tracking, and A/B tests

- Routing and risk rules by market, BIN, and method – version them for testing

- Connected data linking payment gateway data with customer behavior analytics for a complete view

Yuno unifies event streaming and batch reporting. It harmonizes data across processors. It lets you update routing and risk logic without redeploying.

Use data-driven insights to improve approval algorithms

Let the data suggest the next best experiment:

- Switch to domestic acquiring for high‑volume markets with cross-border declines

- Turn on network tokens for issuers that reject PANs but accept tokens

- Add or remove 3DS by risk tier, not by market average

- Retry soft declines within a latency window and cascade to a secondary provider

- Adjust MCC or descriptor formatting where issuers are sensitive

- Send Level 2/3 data for eligible credit cards to improve acceptance with some issuers

These tactics convert analytics into approvals. Test, measure, and scale wins.

The best teams take a data-driven approach to optimization. They let transaction data guide their payment routing strategies instead of relying on assumptions.

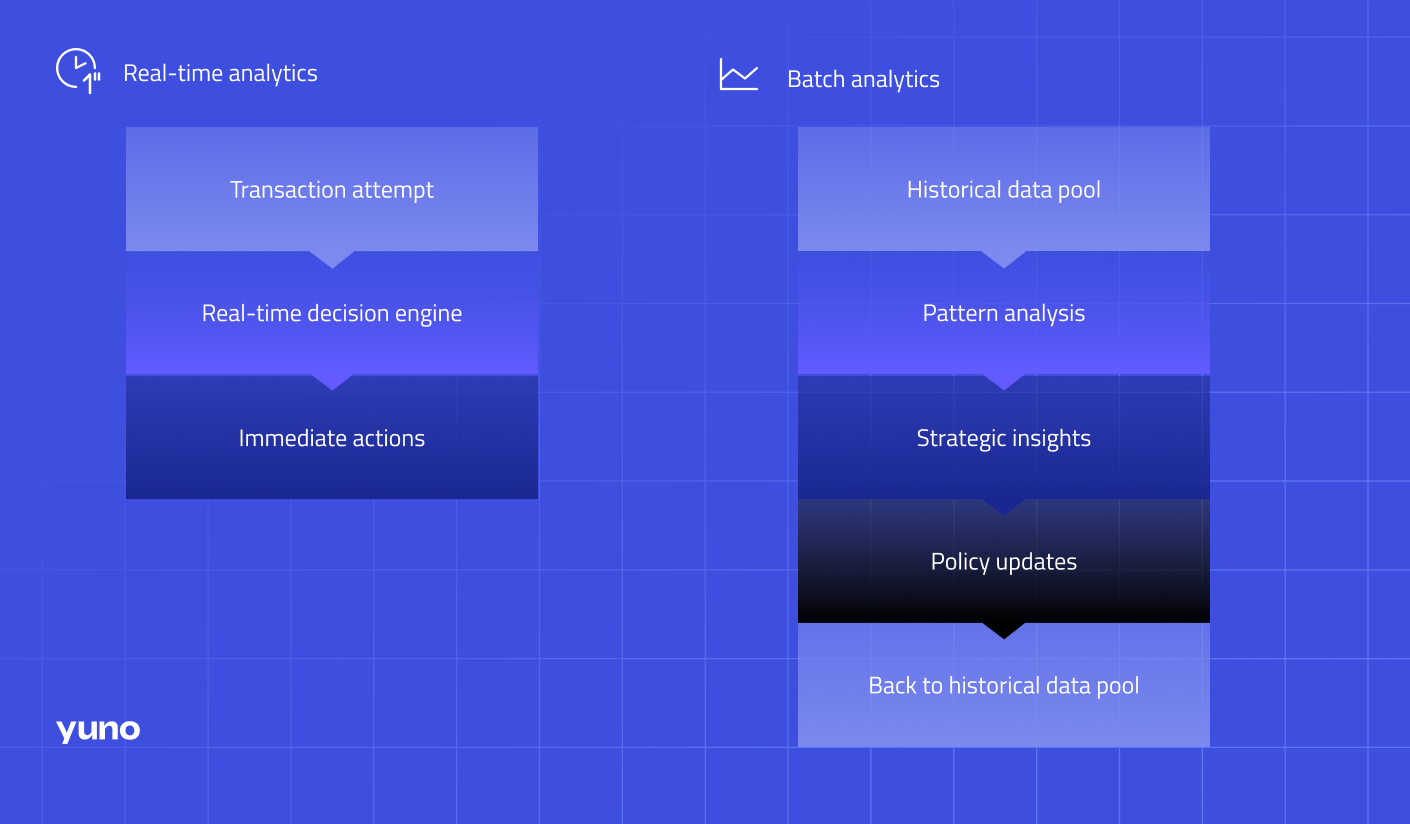

Real-Time vs. Batch Analytics: When Each Matters

Real-time analytics – act in the moment

Use real-time signals to make decisions before authorization:

- Route by live provider performance and issuer responsiveness

- Trigger dynamic 3DS and risk step‑ups only when needed

- Retry soft declines within milliseconds while the customer still waits

- Fail over instantly if a payment gateway degrades

Real-time observability speeds recovery. It protects conversion when conditions shift.

For online payments, milliseconds matter. Even a 100ms delay in page load time can hurt conversion rates by up to 7%. The difference between a completed sale and cart abandonment can be a fraction of a second – that's all it takes in processing delay.

How Yuno applies this:

- Smart payment routing monitors latency and approval trends, and shifts traffic automatically

- Pre‑auth screening filters risky traffic to protect authorization rates downstream

- Instant cascading and retries recover legitimate payments without new code

Batch analytics – learn and optimize

Use batch analysis for deeper insights and strategic changes:

- Cohort analysis by BIN, issuer, market, and product line

- A/B testing across routing tables and 3DS policies

- Pattern analysis for weekend vs. weekday patterns and seasonality

- Chargeback root cause analysis and policy tuning

Batch work turns noise into durable playbooks. You can operationalize them in your routing and risk layers.

When analyzing payments over longer time periods, you discover patterns that real-time data can't reveal:

- Seasonal trends

- Customer behavior shifts

- Long-term performance characteristics of different payment methods

Understanding these payment metrics helps teams make data-driven decisions. They stop operating on assumptions.

Each metric reveals specific optimization opportunities. You discover them when you dig into the transaction data behind it.

Specific Use Cases That Tie Analytics to Approval Gains

Raise approvals in a new market

The pattern: Cross‑border declines spike for Brazil cards routed to non‑domestic acquirers. Latency also rises during local banking hours.

The move:

- Switch to a domestic acquirer for Brazil BINs

- Enable network tokens

- Set a weekday routing rule to the fastest provider

Result: higher issuer trust and lower latency lift approvals. Analytics proves the delta by issuer cohort.

When accepting payments in new markets, understanding local customer behavior becomes critical – so does understanding issuer requirements.

How Yuno helps: Instantly add local providers. Route Brazil BINs domestically. Monitor live lift without custom builds.

Reduce "do not honor" declines

The pattern: "Do not honor" clusters around certain BINs and time windows.

The move:

- Retry soft declines within 500–800 ms

- Cascade to a secondary provider with stronger issuer links

Result: Measurable retry success and fewer customer drop‑offs. Keep the logic only where analytics shows lift.

How Yuno helps: Configure targeted retries by reason code and BIN. Manage fallbacks centrally through intelligent payment routing.

Cut false declines without raising fraud

The pattern: Low‑risk customers fail 3DS more than they succeed in a specific market.

The move:

- Shift to dynamic 3DS using device and history risk bands

- Restrict step‑ups to medium/high risk only

Result: Lower abandonment, steady fraud. Approval rate rises for good cohorts.

By analyzing customer behavior patterns, you can distinguish loyal customers from suspicious activity, all without friction.

How Yuno helps: Align risk scoring with payment routing and 3DS policies. Monitor in real time.

Optimize wallets and alternative payment methods

The pattern: Wallet usage grows but fails at higher rates. Token provisioning issues create the problem. Customers prefer digital wallets for convenience, but technical issues create friction.

The move:

- Monitor wallet‑specific error codes

- Fix provisioning flows

- Route fallbacks to credit cards with network tokens

Result: Higher wallet acceptance and a clean card fallback path. Support the payment methods customers prefer, and maintain high authorization rates.

How Yuno helps: Track method‑level KPIs. Automate fallback paths in routing rules.

How Analytics Feeds Yuno's Smart Routing

Data doesn't win on its own. It needs to drive decisions:

- Live provider performance informs payment routing split and failover

- Issuer and BIN trends pick the right acquirer, tokenization, and MCC/descriptor

- Reason code patterns trigger targeted retries or cascades

- Risk signals decide when to step up authentication

With Yuno, these insights become rules you can deploy quickly. You route payments smarter. You approve more transactions.

Teams use the same analytics to sunset underperforming paths. They scale the ones that win. This data-driven approach to payment processing delivers valuable insights that compound over the long term.

Measuring Success and Continuous Improvement

Set KPIs for approvals and declines

Define a small set of headline KPIs for leadership:

- Authorization rate

- False declines

- Fraud

- Cost per accepted transaction

Underneath, track the diagnostic payment metrics in the table above. Set goals by market and method – benchmarks vary by issuer, geography, and product.

Monitor changes and adjust over time

Move from one‑off dashboards to an operating cadence:

- Real-time alerts for latency spikes and provider degradations

- Weekly reviews: cohort performance by issuer, BIN, and method

- Monthly A/B test readouts with guardrails for fraud and cost

- Quarterly market audits and roadmap updates

This rhythm helps you catch issues early. It helps you compound wins. Continuous analysis of payments creates a culture of optimization, which delivers compounding benefits.

Stay ahead with ongoing analytics and innovation

The payment landscape shifts fast. New payment methods, issuer policies, and risk vectors appear every quarter.

Keep an eye on:

- Local payment methods and domestic acquiring expansion

- Network tokenization coverage by issuer and card type

- 3DS 2.x adoption and friction performance

- Data enrichment (Level 2/3) and descriptor experiments

Use batch analytics to validate each change and real-time controls to deploy safely.

Understanding what customers prefer evolves as new options emerge. This makes continuous payment analysis essential for long-term competitiveness.

Each role benefits from data-driven decision-making, powered by comprehensive payment analytics. This transforms transaction data into strategic advantages.

A 30‑Day Plan to Put Payment Analytics to Work

Week 1 – Unify & instrument

- Centralize processor logs, reason codes, and risk signals

- Normalize decline categories and tag BIN/issuer/market on every event

- Set alerts on latency, declines by reason, and provider error spikes

Week 2 – Find & size the biggest gaps

- Rank markets, issuers, and payment methods by lost approvals

- Quantify "soft" decline segments fit for retries or cascades

- Identify 3DS flows with high friction for low‑risk cohorts

Week 3 – Test targeted fixes

- A/B test payment routing changes for top two markets

- Turn on network tokens for issuers with clear preference signals

- Pilot dynamic 3DS with strict guardrails on fraud

Week 4 – Scale what worked

- Roll out winning routes and risk tiers to more cohorts

- Set weekly reviews and monthly audits

- Retire underperforming paths and codify new playbooks

Yuno supports this plan out of the box. It offers unified analytics, rapid payment routing changes, adaptive risk, and provider expansion without new integrations.

This structured approach ensures valuable insights translate into measurable improvements. Improvements that show up across online payments and all other channels.

Conclusion

Payment analytics is the missing link – the link between an approval rate you report and an approval rate you control.

When you unify data, act on real-time signals, and test targeted changes, you turn declines into decisions. Decisions turn into revenue.

Moving from basic payment analysis to comprehensive payment analytics transforms how you approach payment processing. You shift:

- From reacting to problems to preventing them

- From accepting cart abandonment to understanding and fixing its root causes

- From managing fraud detection separately to integrating it seamlessly with conversion optimization

Yuno makes this practical:

- One platform unifies your data

- Routes smarter in real time

- Aligns risk to conversion

Merchants often see meaningful lifts within weeks. The valuable insights gained from analyzing payments at this level create competitive advantages that compound over the long term. You improve revenue and customer experience and reduce fraud and operational costs.

FAQ

What is payment analytics, and why is it important?

Payment analytics tracks and analyzes transaction data. It reveals trends, root causes of declines, and optimization opportunities. It's essential for maximizing approvals, minimizing false declines, and managing cost and risk with precision.

Basic payment analysis only connects some dots. But comprehensive payment analytics connects every data point. From issuer behavior to customer behavior patterns into actionable insights.

How can payment analytics improve my approval rate?

Analytics shows where and how to intervene:

- Local vs. cross‑border payment routing

- Issuer‑specific tokenization

- Targeted retries

- Dynamic 3DS by risk

Teams use these insights to cut false declines. To lift authorization rates without adding friction. By understanding what payment methods customers prefer and how different issuers respond to various signals, you can optimize every transaction for success.

What tools should I use for payment analytics?

Choose a platform that:

- Unifies data across processors

- Standardizes reason codes

- Supports both real-time decisions and batch analysis

- Integrates payment routing, retries, and fraud detection controls so insights feed action

That's the approach we built into Yuno – unified analytics, smart payment routing, and adaptive risk in one place.

The right tools deliver valuable insights – they don't require extensive custom development or integrations.