Dynamic Payment Routing vs. Smart Routing: What’s the Difference?

Dynamic and smart payment routing sound similar, but they solve different problems. This guide explains how each approach works, when to use them, and how they help U.S. merchants improve approval rates and reduce declines.

Navigating Payment Success in a Competitive Digital Landscape

Payment success is no longer just an operations concern. It is a growth lever.

Every declined transaction affects revenue. It also affects customer trust, conversion rates, and lifetime value. When declines add up, they hit the bottom line fast.

Payment routing helps by choosing the best path for each transaction. In milliseconds, a routing engine decides where to send a payment based on performance and context. This is how payment routing works behind the scenes.

Modern payment infrastructure evaluates the payment processor, card network, issuing bank, and transaction details. The goal is simple. Route the payment through the option most likely to approve it.

Stripe explains this flow in its overview of payment processing and acceptance.

Many teams adopt dynamic payment routing first. It helps respond to real-time issues like outages or latency spikes. Worldpay notes that merchants using adaptive routing often see better success rates during volatility (Worldpay payment acceptance insights).

Still, dynamic routing and smart routing are not the same. Understanding the difference helps you choose the right routing strategy for your business.

Understanding Payment Routing – Basics and Types

What Is Payment Routing?

Payment routing decides how a transaction moves from checkout to approval. It selects the processor or gateway that should handle the payment.

The routing engine looks at factors such as:

- Credit card or debit card type

- Transaction amounts

- Customer location

- Card network behavior

- Issuing bank patterns

- Risk signals and past outcomes

Based on this data, it sends the transaction to the best option. Stripe describes this logic in its guide to payment acceptance optimization.

Types of Payment Routing

Static routing

A static route follows fixed rules. Traffic always goes to the same processor first.

This approach is easy to launch. It is also fragile. When conditions change, static routing cannot adjust.

Dynamic payment routing

Dynamic routing reacts to live conditions. It monitors uptime, latency, and approval performance.

If a payment processor slows down or fails, traffic shifts automatically. This helps prevent declines caused by technical issues or outages.

Smart routing

Smart routing uses data to predict the best route before a problem occurs.

It looks at historical outcomes, BIN-level trends, card network behavior, and issuing bank preferences. GoCardless explains this predictive model in its guide to intelligent payment routing.

How Routing Improves Approval Rates

Routing improves performance in two ways.

Dynamic routing reduces declines when systems fail. Smart routing improves outcomes by choosing the best path upfront.

Both approaches help reduce soft declines, including those caused by insufficient funds, timeouts, or risk checks. Fewer declines mean fewer retries, lower support costs, and more predictable revenue.

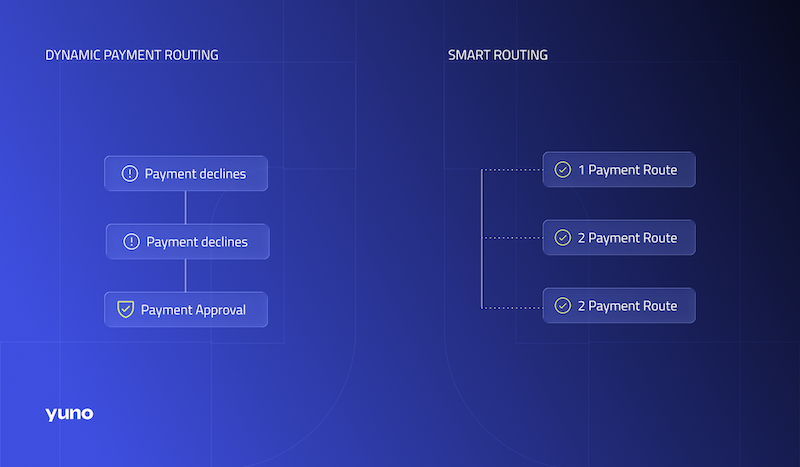

Dynamic Payment Routing vs. Smart Routing – Key Differences

Definitions at a Glance

- Dynamic payment routing reacts to real-time signals like latency, uptime, and approval drops. It reroutes traffic when problems happen.

- Smart routing predicts the best path using historical data and context. It selects routes based on likelihood of approval.

How Each Approach Improves Performance

Dynamic routing

Dynamic routing is reactive.

If a processor degrades, traffic moves instantly. This reduces declines caused by outages, latency spikes, or regional slowdowns. It is especially useful for cross border payment flows where performance varies by region.

Dynamic routing protects reliability when conditions change fast.

Smart routing

Smart routing is proactive. It predicts which path is most likely to succeed for a given transaction. It can steer high-risk payments, specific card networks, or certain issuing banks to providers with better historical outcomes.

This reduces false declines before they occur. It also helps protect legitimate customers from unnecessary friction.

When to Use Each Approach

Choose dynamic routing when:

- You need fast failover

- You operate across many regions

- Provider performance changes often

Choose smart routing when:

- You process high volumes

- You want consistent optimization

- You want fewer manual rules

Many modern routing solutions combine both.

How Yuno Puts Intelligent Routing to Work

Yuno unifies payment orchestration in one platform. Teams can manage providers, apply routing rules, and monitor performance through a single API and dashboard.

Yuno supports:

- Dynamic and smart payment routing strategies

- Automated fallbacks to recover failed transactions

- No-code controls for fast updates

- Centralized analytics for approval rate and latency

- Built-in security for high risk environments

By optimizing routing, merchants reduce declines, improve authorization rates, and unlock cost savings. These gains compound over time and strengthen the bottom line.

Conclusion – Choosing the Right Routing Strategy

The difference is simple. Dynamic payment routing reacts in real time. Smart routing predicts outcomes using data.

Both approaches reduce declines and improve approval rates. The right choice depends on your volumes, regions, providers, and risk profile.

Yuno brings both together in one orchestration layer. That lets teams move faster, reduce costs, and capture more revenue without rebuilding checkout.

FAQ

What is the main benefit of dynamic payment routing?

It adapts to real-time conditions to keep payments flowing during outages or slowdowns.

How does smart routing reduce declines?

It predicts the best route using data from past outcomes, card networks, and issuing banks.

Can businesses use both routing types together?

Yes. Many merchants combine dynamic and smart routing to balance real-time protection with predictive optimization.

%20(1).png)