Transforming business payment strategies with advanced analytics

Advanced payment analytics, utilizing machine learning, is transforming the analysis of payment data and the prediction of customer behavior. This technology enables companies to derive deep insights from transactions, streamline operations, and improve customer experiences through advanced algorithms.

The role of machine learning in payment analytics

Understanding machine learning

Machine learning (ML), a branch of artificial intelligence (AI), involves training algorithms to recognize patterns and make data-driven predictions. Unlike traditional programming, which follows specific instructions, ML algorithms learn from historical data, allowing them to identify trends and generate insights. This capacity for adaptation is particularly beneficial in the dynamic field of payment analytics.

Significance of payment analytics

Payment analytics examines transaction data to uncover patterns and trends, informing business strategies. It encompasses transaction volumes, payment methods, customer demographics, and purchasing behaviors. Through this analysis, businesses can optimize operations, and enhance customer experiences, leading to improved higher approval rates.

Analyzing payment data with machine learning models

Data collection and preparation

The process begins with collecting payment data from various sources, such as point-of-sale systems, online transactions, and mobile payments. The data is then cleaned and preprocessed, ensuring accuracy and consistency. This stage includes handling missing values, normalizing data, and categorizing transactions. Proper data preparation is essential for building reliable ML models capable of accurately predicting customer behavior.

Feature engineering

Feature engineering involves selecting and transforming variables to enhance ML model performance. In the context of payment analytics, this may include factors like transaction frequency, average transaction value, payment method preferences, and customer demographics. Crafting meaningful features enables the model to better understand and predict customer behavior, thereby improving prediction accuracy.

Model training and validation

With prepared data, the next step involves splitting it into training and validation sets. The training set is used to develop the ML model, while the validation set assesses its performance. Common ML algorithms in payment analytics include decision trees, random forests, neural networks, and support vector machines. These models are trained to identify patterns in payment data, and model validation ensures they perform well on new, unseen data, which is crucial for practical applications.

Model deployment and monitoring

Post-training, the ML model is deployed to analyze real-time payment data. Ongoing monitoring ensures the model's accuracy and relevance, allowing businesses to make informed decisions. Regular updates and retraining are necessary to adapt to changing customer behaviors and market conditions, maintaining the model's effectiveness over time.

Predicting customer behavior with machine learning

Customer segmentation

ML can identify distinct customer segments based on payment behaviors. By clustering customers with similar purchasing patterns, businesses can customize marketing efforts and product offerings to cater to each segment's needs. For instance, high-frequency shoppers might receive loyalty programs, while occasional buyers could be targeted with promotional offers, enhancing customer engagement and satisfaction.

Churn prediction

Predicting customer churn is critical for retaining valuable customers. ML models can detect early signs of churn, such as reduced transaction frequency or changes in payment methods. By addressing these indicators proactively, businesses can implement strategies like personalized discounts or enhanced customer support to lower churn rates, stabilize the customer base and maximize lifetime value.

Fraud detection

Fraud detection is a critical concern in payment processing. ML algorithms enhance fraud detection by analyzing transaction patterns and identifying suspicious activities. These models can flag anomalies, such as unusual transaction locations or atypical purchase amounts, enabling prompt action to prevent fraud. Advanced fraud detection protects businesses and customers from financial losses and security breaches.

Enhance business performance

Advanced payment analytics, powered by machine learning, is transforming how businesses understand customer behavior and make smarter decisions. By leveraging payment data, companies can gain insights that not only improve customer experiences but also drive growth.

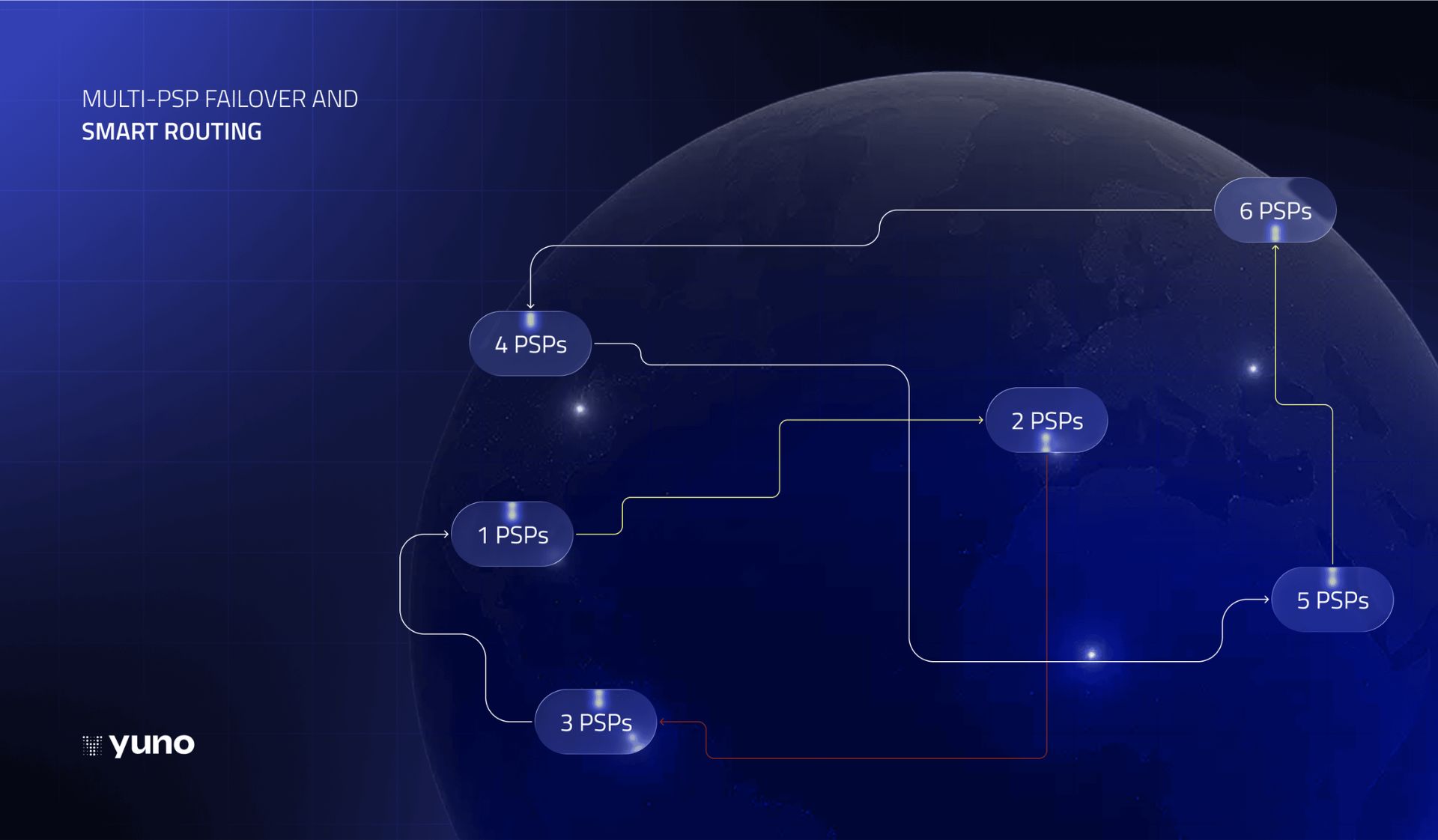

Integrating analytics into payment processes enables businesses to track transactions in real-time, optimize payment routing for better approval rates, and spot trends that help reduce fraud.

As technology advances, these innovations in payment analytics will unlock new opportunities, improving operational efficiency, deepening customer relationships, and boosting overall business performance.