Full shopping cart: payment methods for retailing

Shopping has never been easier, with shoppers making purchases from the comfort of their sofas while watching TV. This shift towards online shopping offers unparalleled convenience, catering to the busy lifestyles of modern consumers. To truly succeed on this trend, retailers must adopt an omnichannel approach that integrates both online and offline shopping experiences.

One of the primary challenges in this digital transformation is the need to offer payment options that cater to diverse preferences. Integrating multiple payment methods such as credit cards, digital wallets, and buy now pay later (BNPL) can significantly enhance the customer experience.

By implementing technological advancements based on understanding and anticipating customer expectations, retailers can provide a seamless and secure shopping experience that meets the evolving needs of their customers. An omnichannel strategy, coupled with a variety of payment options, is crucial for retailers to thrive in today's market.

Payment preferences in the retail market

A retail essential

The first payment method you should be ready to process is credit cards. Credit cards have long been a staple for retail transactions, providing convenience, security, and attractive rewards programs for customers. However, for retailers, there are significant considerations to keep in mind, particularly regarding the associated costs.

One major challenge is the high processing fees linked to credit card payments, which can significantly impact profit margins. These fees, often ranging from 1.5% to 3% per transaction, can add up quickly. Retailers must weigh the benefits of accepting credit cards against these costs and consider strategies such as negotiating lower rates with payment processors or incentivizing alternative payment methods.

Additionally, in regions like Latin America and Asia-Pacific, the penetration of banking services remains relatively low, with only 74% adoption in LATAM as of 2021. This limitation affects the widespread adoption of credit cards, posing unique challenges for retailers operating in these markets. To address this, it is crucial for retailers to adapt to local credit card providers and payment preferences, ensuring they meet the needs of their diverse customer base.

Diverse payment methods for retail success

Shoppers are mainly interested in convenience, which explains the increasing use of digital wallets. Digital wallet users are reported to spend 17% more when shopping in retail, underscoring the impact of payment methods on spending habits. For regions where digital wallets and credit cards are less prevalent, bank transfers play a significant role.

Additionally, younger consumers are increasingly turning to Buy Now, Pay Later (BNPL) services. BNPL offers an interest-free option to pay over time, enhancing affordability and making it an attractive choice for many shoppers. This method is projected to grow at a compound annual growth rate (CAGR) of 24.5% from 2022 to 2028, reflecting its rising popularity.

For retailers, integrating these payment options is essential. Offering flexible payment solutions not only meets the evolving demands of modern consumers but also increases customer satisfaction and loyalty. By embracing these methods, retailers can drive growth in today's dynamic market and stay competitive.

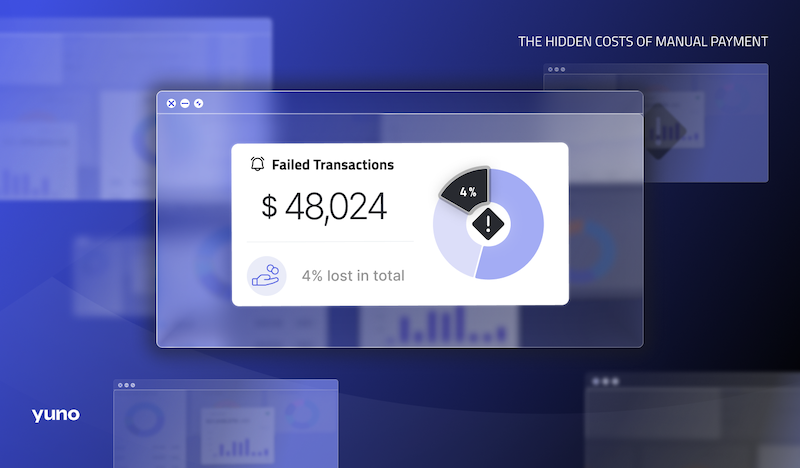

How a payment orchestrator can solve retail payment problems

Checkout experience

A seamless checkout process is crucial for reducing cart abandonment rates. The checkout builder allows retailers to reduce friction by streamlining the payment process and minimizing unnecessary steps. Moreover, it enables merchants to align the checkout with their brand, ensuring a consistent and professional appearance.

By offering a tailored and efficient checkout experience, retailers can boost customer satisfaction and encourage repeat business. The personalized approach ensures a smooth and satisfying customer journey from start to finish, making it an essential part of a successful payment strategy.

Smart Routing

Smart routing technology optimizes payment processing by automatically directing transactions to the most efficient and cost-effective payment gateways. This can significantly improve transaction approval rates and reduce processing fees, ensuring a smoother payment experience for customers.

By ensuring that each transaction is processed through the most suitable gateway, retailers can enhance the overall customer experience and boost their bottom line. Additionally, smart routing minimizes payment failures, leading to higher customer satisfaction and retention.

Tokenization benefits

Tokenization enhances security by replacing sensitive payment information with unique identifiers, significantly reducing the risk of data breaches. This advanced security measure ensures that even if a data breach occurs, the sensitive payment information remains protected and uncompromised.

Furthermore, when payment details are tokenized and saved during a customer's initial purchase, the tokenized data enables one-click payments. This eliminates the need to re-enter payment information, streamlining the checkout process. As a result, the user experience is greatly improved, which in turn reduces cart abandonment rates.

Automated reconciliation

Efficient financial management is essential for retail operations. Automated reconciliation tools help by matching transactions with payments, reducing errors, and saving time. This accuracy ensures that financial records are up-to-date and reliable, facilitating better financial management.

Retailers benefit from streamlined reconciliation processes, which free up resources and allow them to focus on core business activities. Improved financial oversight can lead to more informed decision-making and overall business growth.

Centralized Ppayment solutions

Efficient payment integration is key to a successful retail operation. By offering a variety of payment options tailored to customer preferences and implementing advanced security measures, retailers can enhance the customer experience and streamline their payment processes.

Yuno is an excellent solution for retailers looking to elevate their payment systems. Yuno's platform provides seamless integration with multiple payment gateways, ensuring customers can choose their preferred payment method without hassle. By centralizing various payment options, Yuno simplifies transaction management, eliminating the need to handle multiple payment systems individually.

Moreover, Yuno enhances the overall shopping experience with tools like a checkout builder that reduces friction, smart routing technology that optimizes payment processing, and automated reconciliation for efficient financial management. These capabilities ensure a consistent, professional, and secure checkout process, improving customer satisfaction and loyalty.

Explore how Yuno can enhance both your shoppers' experience and your business operations. Book a demo to simplify payment management while ensuring your business stays ahead in security and customer satisfaction.